Best billing and invoicing software for small businesses in India. Want to jump straight to the answer? Best Invoicing Software for Small Business Billing for most people is Zoho Invoice and FreshBooks.

These that offer credit terms for their products and services need to know this. How to invoice their customers, and whether that customer is an individual or a company.

This business sends products first. And provide services. And pay the customer later. Payment is requested through a document called an invoice.

It cuts your paperwork by Best Invoicing Software and learning correctly and efficiently. And it pays off fast. This improves the overall financial management of your small business.

In this Freshbook tool, you should consider. I recommend This simplifies your Best Invoicing Software process. It is absolutely easy to use online invoicing software in Freshbook. Which pays you 2x faster.

What is the Best billing and invoicing software for small businesses in India?

Here are my picks for the Best billing and invoicing software for small businesses in India to use this year.

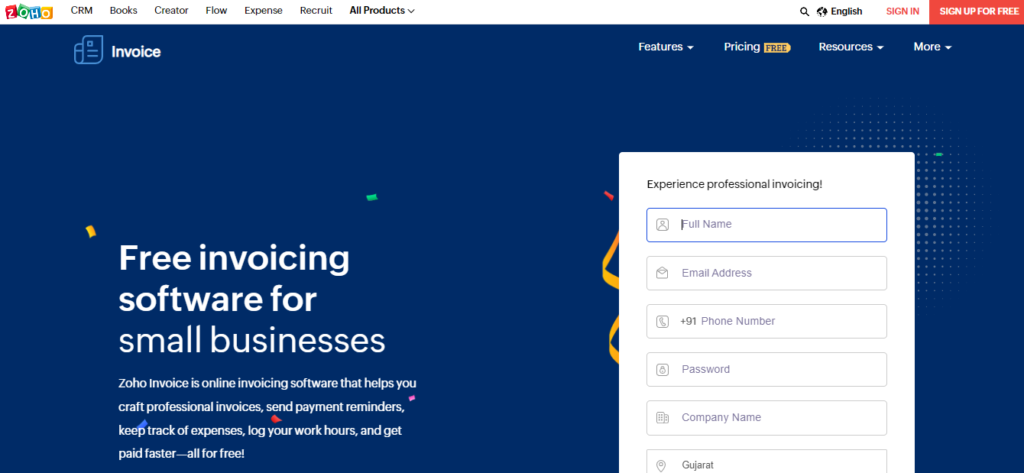

1. Zoho Invoice. Best Overall Best Invoicing software for Small Business.

OVERVIEW:

Zoho Invoice is the online Best invoicing software. This works very well for you to create professional invoices, send payment reminders, keep track of expenses, and moreover, you can finish your long hours of work in a few hours. It has been designed by looking at all the processes involved in your challan.

BEST FOR:

It doesn’t matter if your business is small or big. Makes your incoming invoicing faster, and easier to use, and with it comes greater productivity. The one they are looking for, that’s why I bring it to the first place on my list.

The process of Invoicing Software below is only three steps.

1 Step Create Professional Invoices: Creating professional invoices is essential for you to create the right brand image, build trust with customers, and encourage payments. Zoho Invoice lets you create perfect invoices in seconds. (Choose from a gallery of beautiful templates. Allows you to automate recurring Invoicing Software)

2 Step Send Invoices Effectively: How does Zoho Invoice help ensure that the invoices you send actually reach your customers? And with this, your customers can appreciate timely reminders to clear their past dues and avoid penalties. (Send invoices via SMS, email, and customer portal, and follow up on automatic payment reminders)

3 Step Get paid on time: An easy payment process helps you get paid on time. Can provide multiple payment options. Your customers can choose to make their payments securely. (Accept Credit Cards, Bank Transfers, Cash & Cheques)

KEY FEATURES:

Expense Tracking: Track your unbilled expenses until you are reimbursed by your customers. Zoho Invoice can autoscan your expense receipts, and calculate your travel expenses based on GPS and mileage.

Time Management: Effortlessly track time, and bill your clients for the hours you spend on their projects. Just start a timer from your computer, mobile, or Apple Watch whenever you’re done – Zoho Invoice helps log every billable minute in a clear calendar format.

Estimates: Make sure your customers agree with your prices before you start billing. Send estimates, including quotations and discounts, to your customers for approval, then turn them into projects or Invoicing Software.

Detailed Reports: Track your business performance so that you can make informed decisions. Allows you to get quick insight through vibrant graphs and charts or check out the dashboard to run 30+ real-time business reports.

PRICING:

The plan for the Zoho invoice starts with a free signup. Apart from this, to start the paid plan, you have to contact the Zoho team.

Lastly, I highly recommend using Zoho Invoicing Software, it does not charge any hidden fees. whatever happens. Keeps the price in front of you. They want to support freelancers, entrepreneurs, and SMEs by providing them with a powerful invoicing Software platform absolutely free of cost.

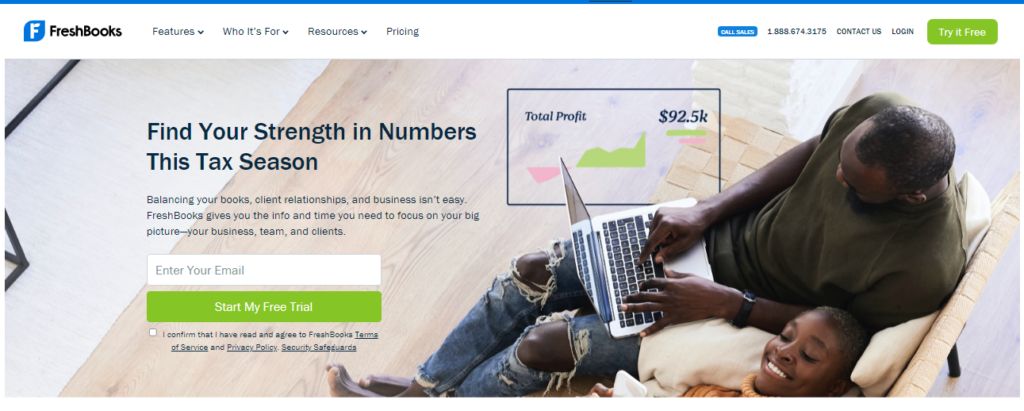

2. FreshBooks -Best Invoicing software for Entrepreneurs, Agencies, & SMBs

OVERVIEW:

It is considered the best accounting software for FreshBooks entrepreneurs and agencies. Which is operability for small businessmen. If you want Let’s grow your company development. So FreshBooks is a good choice. This Freshbook makes small business invoicing and billing so simple. Which will surprise you when you have to focus on your love and how fast you pay. Who would have thought that invoice generator software could do this?

BEST FOR:

Freshbook stands out as the best SMB accounting for Invoicing Software. But it proves to be the best tool for managing expenses, during trekking time, tracking payments, and managing the project.

KEY FEATURES:

It’s easy to run, like your customers with a professional-looking invoice that takes just seconds to create. Which is the best part, you can pay fast. It can organize expenses spontaneously, it can bid farewell to that shoebox of receivables. This makes it easy to log in and track expenses in the Freshbook to track every dollar spent so that you are always ready for tax time.

This can make time tracking workable. When you track while using FreshBooks, you always invoice for what you deserve. And you and your team can log your hours. And then automatically place them on the Invoicing Software.

It can seamlessly collaborate on projects. Now you can keep all your conversations, files, and feedback in one place. And with it, you can sync your team and keep your projects on schedule.

Allows easy-to-use double-entry accounting. It can use automated checks and balances to ensure accuracy and compliance, while financial information helps you make smart business decisions and makes working with your accountant even easier.

It works well with the Freshbook mobile app. With the Freshbook mobile app, you will easily connect with your customers and be able to take care of your account anywhere.

It is very easy to buy. Which paid fast when you accept online credit cards in Freshbook, you can pay fast for 11 days. Can say hello to an automated deposit and goodbye to chasing clients for checks.

PRICING:

From $15 per user/month.

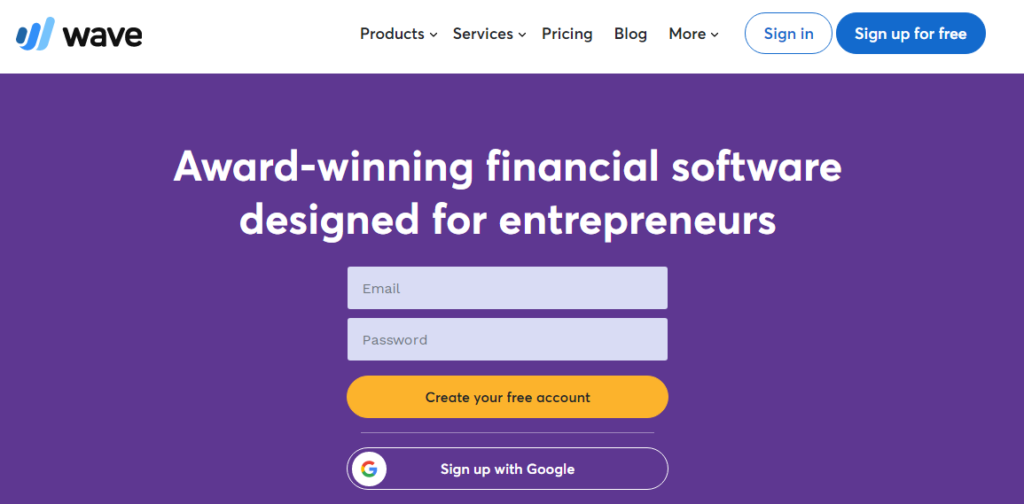

3. Wave – Free accounting software for entrepreneurs

OVERVIEW:

This is a free Invoicing Software solution for wave entrepreneurs. But this is true. Some features are provided for free in their software. What feature does Wave provide for free? As below you will be able to see some feature which is being provided for free.

BEST FOR:

You do not need to do this wave accounting software. If you want to manage some data. It allows you to use their mobile app. You can see the receipt even when offline. If you connect. Then allows you to upload. Not only this, usability, features and mobile apps still rival some of the best-paid accounting solutions on the market today. Which is the fact that you can use Wave for free.

When everything is done neatly, tax time is simple. Wave’s smart dashboard organizes your income, expenses, payments, and invoices. Bank data connections are read-only and use 256-bit encryption. Servants are kept under physical and electronic security. Wave is certified to deal with PCI Level-1 credit card and bank account information.

KEY FEATURES:

- Automatic receipt recording

- Invoice in any currency

- Unlimited guest partners

- Once approved, send estimates and convert them to invoices

- Receipt scanning

- Income and expense tracking

- Bank and credit card connection

Wave uses real, double-entry accounting software. Don’t know what Okay. Accountants do, and they will thank you for it. You can manage multiple businesses with a wave account, which is perfect for any entrepreneur. Personalize your Invoicing Software with customization and professional templates.

PRICING:

From Free

4. QuickBooks–Best for Small Business

With your accounting data organized on this cloud, you can easily track sales, and create invoices. You can send more, and you can measure how your business is doing at any time. It is easy to use, and you do not need an accounting or finance specialist to use this QuickBooks accounting Invoicing Software.

KEY FEATURES:

- Track and manage your sales tax

- Keep track of sales, expenses, and profits

- Transactions in multiple currencies

- Recurring payment schedule to save time

- Track project or job profitability

- Create and send custom invoices, sales receipts, and estimates

- Create purchase order

- What is special about this tool?: This QuickBooks online mobile app automatically stores your data in the cloud. And syncs your device, making it easier to manage your business.

PRICING:

$ 10.36 per user/month

5. Invoice2go- Flexible Toolkit

OVERVIEW:

This tool Invoice2go is another basic yet efficient online Invoicing billing software provider. This makes it a great option if you need simple and easy-to-use invoicing software without additional functions. Then it will fit you.

BEST FOR:

Creating an invoice is very easy with Invoice2go. Choose one of these pre-made templates and add or create a logo. Once you are happy with your invoice, all you need to do is enter a customer’s details and line item.

KEY FEATURES:

You can easily change the layout of your invoice as well as the overall look and feel from your settings at any time. It can add a logo or a recognition badge, choose your own color palette, or even multiple banners and watermarks. You can discover how much time you can save by sending an invoice just after finishing the job. And you can send texts or emails directly from your phone, as well as other methods such as WhatsApp and Skype.

PRICING:

From $ 21 user/year. Free trial for 14 days.

6. OneUp- Banking and Business All in One.

OVERVIEW:

This OneUp is a cloud-based accounting / Best invoicing software. Which is for small to large businesses as well as small-medium. It displays income, expenses, and overall profitability for a specified period of time in a defined currency. The data is provided by OneUp AI which converts bank feeds into accounting entries.

BEST FOR:

Cash flow forecast: from this to this. Looks like how much money the customer expects to receive and pay in the following months. It provides a predictive cash balance. These numbers are fed by bank feeds, oneup AI prediction, and customer entries.

KEY FEATURES:

This invoicing Software: can create or display fully customizable Invoicing Software. Send invoices that can integrate requests for payment. And easily connect to a payment gateway for better customer experience and invoice/payment automatic reconciliation. This has the potential for building an efficient AR automated process.

Invoicing Software Billing: It can turn on the data embedded in the bill in accounting entries. Bills can be captured by PDF files, scanned documents, or digital cameras. And can easily connect to their payment initiation APIs to form the foundation of a true automated AP process.

Purpose: It can create a pop-up message to provide customized advice. This smart advice can be triggered based on customer data, dates, forecast numbers, or your own specifications. You can match messages with your portfolio of products and services to make this a powerful cross-sale and up-sell engine. This gives you the scalability to address a large number of customers.

PRICING:

From $9 user/month. Free trial for 30 days.

7. Square Invoices. Best Invoicing Software

Square Invoice Online is a great Invoicing Software. And offers a free or low-cost plan for in-person invoicing, making it the best billing software option for any small business. Furthermore, service-based businesses need an invoicing solution that allows them to accept payments online, while product-based businesses may need to accept payments in person and manage inventory. Square’s products cover both types of businesses.

KEY FEATURES:

Both the plans for this software Square Invoices allow you to have an unlimited number of invoices, and more than that you can schedule recurring invoices for regular customers.

It allows setting up milestone-based invoicing for longer projects. Square’s other products integrate seamlessly, so if you run your own product-based business. Whether you use Square’s point-of-sale (POS) options to manage sales for an online, mobile, or brick-and-mortar store, you can use inventory management with Invoicing Software.

Key Features Highlighted Below.

- Align scope and pricing with digital estimates.

- Send digital contracts and collect e-signatures.

- Collect over-the-phone payments from your computer.

- Auto-convert accepted estimates to invoices.

- Build milestone-based payment schedules.

- Run detailed business reports.

- Store and manage key customer details with a free Customer Directory.

- Monitor estimates, invoices, and payments from one dashboard.

- Offer options with multi-package estimates.

- Save and reuse custom invoice templates.

- Organize project files into folders for easy access.

- Share project files and status with customers.

- Track open and completed projects.

- Add custom fields to any invoice.

- Select custom invoice layouts that match your brand.

- Send unlimited invoices and estimates from anywhere.

- Schedule recurring invoices.

- Save and charge cards on file.

- Schedule automatic payment reminders.

- Track status in real-time.

- Send digital receipts for any payment.

PRICING:

The plans for Square Invoicing Software start off free. Beyond that, you’ll need to contact the Square Invoices team for a paid plan. (or you must leave an email)

Conclusion.

Selecting the best billing and invoicing software for small businesses in India is a critical step toward enhancing financial management and operational efficiency.

As the business landscape evolves, having a reliable invoicing solution can streamline processes, reduce errors, and save valuable time for entrepreneurs and their teams.

Several software options stand out in the Indian market, each offering unique features tailored to meet the specific needs of small businesses.

For instance, Zoho Invoice is highly regarded for its user-friendly interface and comprehensive features, making it an excellent choice for startups looking to manage their invoicing processes efficiently. Its free plan allows businesses to create and send professional invoices without incurring costs, which is particularly beneficial for new ventures.

FreshBooks is another noteworthy option, especially for businesses needing GST compliance. With its extensive capabilities for generating GST-compliant invoices, managing inventory, and tracking expenses, FreshBooks is designed to cater to the diverse needs of small businesses across various sectors. Its popularity among Indian SMEs demonstrates its effectiveness in simplifying billing processes.

Wave also deserves mention for its quick invoice generation and payment collection features. The ability to create customizable invoices in under 30 seconds and collect payments via UPI and net banking makes it a practical choice for busy entrepreneurs.

The software’s focus on compliance with GST regulations further enhances its appeal to small businesses in India.

QuickBooks stands out for its offline capabilities, allowing users to manage invoicing and accounting without an internet connection. This feature is particularly advantageous for small businesses operating in areas with unreliable internet access.

QuickBooks’s comprehensive suite of tools, including expense tracking and inventory management, makes it a versatile solution for entrepreneurs.

Ultimately, the best billing and invoicing software for small businesses in India should be user-friendly, cost-effective, and equipped with features that streamline financial operations.

By investing in the right software, small businesses can not only enhance their invoicing processes but also improve cash flow management and customer relationships.

Lastly, The right billing and invoicing software can significantly impact the efficiency and success of small businesses in India.

By leveraging these tools, entrepreneurs can automate routine tasks, ensure compliance with regulations, and focus on growing their businesses.

As the market continues to evolve, adopting a robust invoicing solution will be essential for achieving long-term success and sustainability in the competitive landscape of 2025 and beyond.

Hi, Jayprkash Prajapati, As accountants, we take care of your compliance whilst allowing you to concentrate on running and growing your business.

Many people feel that accountants are just there to do the number crunching and provide reports. An accountant’s professional role is to advise and assist in the effective management of a company. Accountants play multiple roles in a business: gathering information, reporting financial results, and preparing taxes. Accountants also help businesses establish internal controls and identify risks and opportunities through research and analysis.

We use award-winning software designed for accountants to provide our clients with real-time insights into their business performance. We also provide clients with access to software like Xero to ensure that they are in control of their business and its financials, not just the accountant.

We believe in high customer satisfaction and ensure you have access to a dedicated qualified accountant when you need help and support. That is I over all your article enjoying. Thank you.

Hi Jerry, I found it wonderful to explain your point clearly with the confirmation. Thank you

Great Blog! Thanks for sharing this awesome knowledge with us.

Thanks 🙂