Reviewed by: Jayprakash Prajapati | Last updated on February, 22, 2026

Best Small Business Checking Account for Startups. Want to jump straight to the answer? The Small Business Checking Account for most people is Brex Cash and BlueVine.

If you started a new small business? Or are you thinking of starting a business? One of them is definitely thinking.

If you have started or are starting a new startup, I offer you That your business needs to be investigated. If you do not do this? It simply means that you are missing something.

When running a small business Checking Account you may have a lot of things to worry about as a person using a personal checking account.

First, you have to make sure that the finances of your business are different from your personal appearance, but I am giving you an in-depth review of the Top Small Business Checking Accounts.

We will cover the top features, benefits, prices, and any potential drawbacks that you should pay attention to.

What is the Best Small Business Checking Account for Startups?

Here are my picks for the Best Small Business Checking Account for Startups to use this year.

1. Brex Cash.

Best Overall Business Checking Account Should Work.

This is the most important thing to know about Brex Cash, it is not a bank account. That is, Brex is not a bank. This Brex Cash is actually part of a new product category called “Cash Management Accounts”. This is designed to do more than a traditional bank account. If you have Brex Cash, you do not need a separate bank account, credit card, and expense software. With minimal deposit, no transaction fees, and no limits, deposits, payments, and tracking make Dashboard absolutely easy.

BEST FOR:

This is the best replacement for a Business Checking Account. For those who do not have a personal credit check, open a Brex Cash account online. From there, it can be free to send ACH and wire transfers – even internationally. And to spend this fund, cash comes with a credit card. You get a cashback every time you pay.

KEY FEATURES:

Designed to give you more control. Some methods such as scheduled and recurring payments, user roles, and transaction approval flow. You can disassemble according to your time. Those who keep spending this policy keep an eye on the trends.

You can manage the cash of your business with confidence.

You can easily take a percentage of your cash in the money market account for earning or depositing at one of our program banks. (FDIC-insured is limited to $ 250,000).

If you pay immediately for eCommerce sales. So you don’t need to wait 14 days to get your hands on your Amazon sales revenue. It can get its cash immediately for advertising, buying a stock list, and making another sale.

Good for that: A non-traditional option that is full of features

2. BlueVine.

Best Perfection for Business Checking Account.

This is better banking flexible funding for your business, payments, and checking made for business. People on BlueVine have given their reviews 5 stars 2,444. And this BlueVine is an online business bank. Which focuses on small businesses. And they eliminate the most common trade check fees. So that you can keep more of your money in your business.

BEST FOR:

This BlueVine Business Checking offers no monthly, incoming 2 wire, ATM, or NSF fees, dedicated live support, and 1.0% interest (20x national average 4) checks on balances of up to $ 100,000.1. you can use the mobile app to deposit checks, which can see your balance and other everyday banking activities. you can also withdraw cash using BlueVine Business Debit Mastercard®, and your deposit is FDIC-insured through BICorp Bank for at least $ 250,000.

KEY FEATURES:

BlueVine’s mission is designed for them. Which is capable of empowering small businesses through innovative banking. It is best able to provide simple, fast, and seamless banking services including access to financial products such as BlueVine Business Checking and Line of Credit, Term Loans, and Invoice Factoring.

Now more than ever, the flexibility of an online business checking account enables you to run your business with extra convenience. Who can use the Clueless mobile app for easy access to their banking – and can deposit a mobile check from you, check your account balance, and transfer funds.

Good for that: earning 1% interest and accessing the best-in-class online banking facilities

3. Bank Novo.

Best Perfection for Business Checking Account.

Another option for this simple business check is Bank Novo. Which is the best service among all services? You do not pay any fee for your bank Novo Business Checking Account. And it allows businesses to have access to members-only discounts on business tools such as Google Cloud, Salesforce, Hubspot, Stripe, and Zendesk Essentials.

BEST FOR:

The best service is that a minimum deposit of $ 50 is required, but after that, it won’t require you to keep this monthly balance to maintain a Business Checking Account. This Paycheck Protection Program (PPP) Loan This Congress recently passed a new round of Paycheck Protection Program (PPP) loans that were passed in early 2020 to help small businesses that compared to 2020 Have seen a 25% decrease in revenue in a quarter.

KEY FEATURES:

This online gambling is a commercial structure. Which they are currently unable to support, but restricted transactions defined in Federal Reserve Regulation GG are prohibited from being processed through this account or business relationship.

This is your deposit up to the FDIC standard insurance amount, which is currently $ 250,000 per depositor. This insurance is provided through our associate bank, Middlesex Federal Savings. Which is this FDIC certificate number 28368? That can be found on the FDIC BankFind tool.

Good for that: high-tech community banking for new businesses

4. Radius Bank Tailored Checking

Online business Checks for unlimited cashback & transactions.

It is joining forces to offer America’s largest personal loan company and Best Online Bank of 2020 a more holistic set of innovative, award-winning financial solutions for all. Radius was nominated for 2021 Best Bank or Credit Union Online Experience by NerdWallet for its mobile banking app and award-winning online business checking account with unlimited ATM fee waivers and high interest rates!

BEST FOR:

This Checking for Rewards It is rewarded for everyday purchases, and every time you use your radius debit card, it gets a cashback with rewards or a tailed check. The service company has partnered with some of the best financial products to help you spend, save, and save your money (and life).

KEY FEATURES:

And they have partnered with the Ladder, which has reinforced life insurance to be immediate, simple, and smart. They have overcome the obstacles of life insurance to provide you with continuous coverage in 10 minutes or less. You should not pay your money to use it. But take responsibility for your concern. Which is an unlimited discount in Rewarding Checking for any ATM fees you charge.

5. NorthOne.

Great Business Checking Account Review.

This NorthOne Business Checking Account provides you with maximum benefits. It’s less popular than other business checking accounts, but it was designed around the needs of Americans for better business banking. It will build your business, generate employment, and serve your community. It is perfect for working hard. This makes NorthOne the hardest part of running your business.

BEST FOR:

It can provide quick assistance from real humans, and talk to a local customer support specialist who understands your business. If you are facing something technical or non-technical. Then it may fit a platform for you. If you want to register to a NorthOne account. So it is very easy. Such as an FDIC-insured business checking account it takes 3 minutes to reach mobile ACH, wire, check deposit, and 300,000 duty-free ATMs nationwide in a short time.

KEY FEATURES:

Through this application, you can easily get information on the revenue and expenditure of your business. And you have complete control. And you can run your business from anywhere in the world. With the capabilities of a full bank in the palm of your hand, the NorthOne banking experience allows you to save time and money. It automates the time-consuming tasks required to close your books at the end of each month.

- Provides you with such facilities.

- Duty-Free ATM Deposit and Withdrawal.

- Over 300,000 NorthOne-network ATMs.

- Unlimited Payments, Deposits, and Transfers.

- Unlimited Debit Card Usage.

- Pay bills directly from your NorthOne account.

- Unlimited sub-accounts for taxes, payroll, and more.

- Unlimited Application Integration.

- Instant support from our local support team.

- Government-insured FDIC bank account.

- Low wire fees.

- Start with the first deposit of $ 50 or more.

- Free debit card for every owner.

- Mobile check deposit.

- Mobile ACH, Bank Transfers, and Telegrams.

PRICING PLAN:

$10 / month

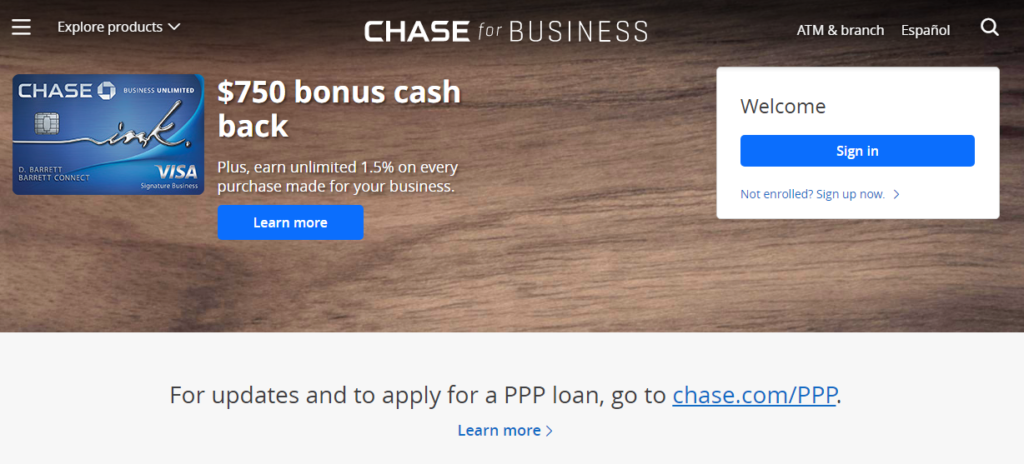

6. Chase Business.

This Chase Business Business Checking Account provides you with maximum benefits With this Chase, you can search for a business checking account for free. This is because you already have a personal checking account or credit card with them.

BEST FOR:

This PPP loan update: This allows us to accept PPP applications. We are experiencing very high call volume and extended wait times related to PPP. This is usually the first-time borrower “including affiliates”. May not have more than 500 employees “or less or more for certain business types for certain SBA size standards”.

KEY FEATURES:

Food services companies with NAICS code 72 cannot have more than 500 employees per physical location and loans can be up to 2.5 times. Average monthly payroll cost of the business, maximum $ 10 million loans (or $ 20 million for the corporate group)

It offers a variety of solutions for Chase for Business owners. These solutions include lines of credit ranging from business checks and savings to cash flow to business loans and major purchases. You can check the business to find the right account for your business structure and size. Learn more about this Chase Business online banking and easily manage your small businesses with online tools and the Chase Mobile App.

7. Apple Bank.

SimpleValue Business Account Checking.

Simplify your banking with our New York Bank Business Checkup. It is located in New York City. If you are in Apple Bank you can consider opening your Business checking account. If your business day presents many challenges, then the last thing you need is a complex checking account. Which is the only solution to a SimpleValue Business Checkup.

BEST FOR:

When you open your Business Checking Account. So you can take advantage of their $ 100 worth of offers. This can be a free business check and enter 150 business check intro, tickets, stamps, and covers – a $ 100 value.

KEY FEATURES:

This applies to sales tax and delivery charges, free business check entry pack orders, and can only be offered for new accounts and new money. it offer can be closed at any time without prior notice. The joint monthly transaction consists of every paid check and every deposit, and charges apply to all transactions exceeding 200 monthly transactions.

Executive Summary.

When selecting the best small business checking account for startups, it is essential to focus on several critical factors that can significantly impact your business operations and financial management.

First, account features and services are paramount. A good business checking account should offer essential services such as online and mobile banking, check-writing capabilities, and bill payment options.

Additionally, features like unlimited transactions, integration with accounting software, and cash management tools can streamline your operations and enhance efficiency.

Next, consider the fees associated with the account. Many banks charge monthly maintenance fees, transaction fees, and other costs that can add up quickly.

Look for accounts with low or no fees, and consider options that allow for fee waivers based on minimum balance requirements or transaction thresholds. Online banks like Novo and Mercury are known for their no-fee structures, making them attractive choices for startups.

Another vital aspect is the interest rates offered on business checking accounts. While many accounts do not provide interest, some online banks like Bluevine and Grasshopper offer competitive annual percentage yields (APY) on deposits, allowing your funds to grow while remaining accessible.

Accessibility is also crucial. If your business involves cash transactions, having a bank with a robust ATM network or local branches can be beneficial. Conversely, if your operations are entirely digital, online-only banks may suffice, providing convenience and lower costs.

Customer support is an often-overlooked aspect that can make a significant difference, especially for startups that may need assistance navigating banking services. Look for banks that offer responsive customer service through various channels, including phone, chat, or email.

Introductory bonuses can also be enticing. Some banks offer cash bonuses for opening a new account and meeting specific criteria, which can provide an initial financial boost for your startup.Based on these considerations, some of the top choices for small business checking accounts for startups include:

The best small business checking account for your startup will depend on your specific needs, including the types of transactions you expect, your cash flow requirements, and your preference for digital versus traditional banking. Evaluating these factors will help you select the account that best supports your business’s growth and financial health.

Conclusion.

Starting your small business is a journey filled with ambition and growth, and choosing the right checking account can be a pivotal step. A well-suited business checking account simplifies your finances, keeps personal and business funds separate, and provides the tools you need to manage transactions effortlessly.

For startups, it’s crucial to prioritize accounts with low fees, easy access, and features tailored to your needs, such as integrations with accounting software and online banking tools. Many banks also offer incentives like free transactions or bonuses for new customers, making this an exciting opportunity to maximize benefits.

Remember, your business checking account isn’t just about storing money—it’s about empowering your operations. Take time to compare options, ask questions, and choose an account that aligns with your goals. With the right partner in banking, you’ll lay a strong foundation for your startup’s financial success. Cheers to your entrepreneurial journey!